when are property taxes due in illinois 2019

There are several convenient ways to pay your real estate property taxes. Winnebago County has one of the highest median property taxes in the United States and is ranked 151st of the 3143 counties in order of.

Illinois Income Tax Rate And Brackets 2019

According to data by the Bureaus of Economic Analysis nonfarm personal income only rose by 10 over the above time period.

. Tuesday March 1 2022. Property Tax First Installment Due Date. Welcome to Property Taxes and Fees.

Illinois Property Tax Rates Specific tax rates in Illinois are determined based on the total tax base or the total value of property with a district. Illinois Statute 35 ILCS 20021-15 provides that all taxes not destroy by per date. Illinois has one of the highest average property tax rates in the.

Beginning May 2 2022 through September 30 2022 payments may also be mailed to. In person weekdays from 830 AM 430 PM at the Will County. Election Night Results Contact Calendar Agendas Minutes Maps Employment.

It is managed by the local governments including cities counties and taxing districts. General Information and Resources - Find information. Joe Sosnowski R-Rockford filed House Bill 5772 which calls for a 90-day delay without penalties on 2019 property tax payments which come due.

The individual tax rate for 2019 is 495. Mail payments to Will County Collector PO Box 5000 Joliet IL 60434-5000. Residents wanting information about anything related to property taxes or fees paid to the county can click through the links in this section.

The median property tax in Winnebago County Illinois is 3056 per year for a home worth the median value of 128100. The data has been adjusted for inflation. By law interest of 2500 per month not to exceed 10000 is assessed after the due date.

Illinois Property Tax Credit on 2019 purchase. Property TaxesMonday - Friday 830 - 430. Paying First Installment Property Taxes Early.

The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. The filing and payment deadline for Illinois income tax returns has been extended from April 15 2020 to July 15 2020. Guide To dual Process Williamson County Illinois.

Mobile Home Due Date. At least 50 of the qualified vehicles miles must be driven in the state and the credit expires at the end of 2020. June 4 2021 Published.

The due date for Tax Year 2019 Second Installment was Monday August 3 2020. Winnebago County collects on average 239 of a propertys assessed fair market value as property tax. The last day to pay the Tax Year 2019 Second Installment before late-payment interest charges was Thursday October 1 2020.

Welcome to Ogle County IL. January 20 2020 - Dr. The 2019 income tax filing and payment deadlines for all taxpayers who file and pay their Illinois income taxes on April 15 2020 are automatically extended until July 15 2020.

The bills are due in May at least 60 days after they are mailed. County Farm Road Wheaton IL 60187. Welcome to Madison County Illinois.

Cook County property taxes Second installment deadline. Martin Luther King Jrs birthday. Each year the tax levy process begins in August.

Due Dates Tax Year 2021 First Installment Due Date. Tax amount varies by county. 173 of home value.

This process includes compiling historical data polling townships for growth and reassessment rates developing revenue projections updating the Citys capital plans and updating the Citys long-term operational plans. The easiest and fastest way to pay your Cook County Property Tax Bill is online. Box 4203 Carol Stream IL 60197-4203.

Property Tax Second Installment Due Date. Your real estate tax deduction for 2020 2019 taxes in Illinois are billed in 2020 is what you paid directly or was taken out of your escrow account less any credit on the closing statement for those taxes the Illinois credit is based on that deduction. Information about Prior Year Property Taxes.

January 1 2020 - New Years Day. Due dates are June 6 and Sept. Property tax due dates for 2019 taxes payable in 2020.

The Second Installment of 2020 taxes is due August 2 2021 with application of late charges moved back to October 1 2021. While Illinois home values dropped property taxes increased by more than 51 alarming many homeowners. The Online Property Inquiry tool updates every hour to reflect the most recent payments.

The Illinois Department of Revenue does not administer property tax. Monday - Friday 715 - 515. Payments and correspondence may always be mailed directly to the DuPage County Treasurers Office at 421 N.

Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year. 191 KB File Size. If Taxes Were Sold.

If you are a taxpayer and would like more information or forms please contact your local county officials. Annually the City Council holds Financial Overview and Tax Levy workshops. Real Estate Tax Due Dates.

At one of many bank and credit union branches across Will County. Scheduled to be held May 12 through May 18 2022. This filing and payment relief includes.

Clicking on the links with this symbol will take you to a county office or related office with its own website while the links without the symbol belongs to a. Hours of operation are. DuPage County Collector PO.

Yes to did you own your primary residence.

Untitled Estate Agent Real Estate Agent Real Estate

Pin By Keiram On We Hunt The Flame Sentences Chemistry Ya Fiction

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Property Tax Prorations Case Escrow

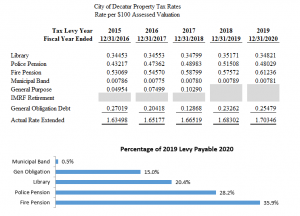

Property Tax City Of Decatur Il

These Are The Best And Worst States For Taxes In 2019

State By State Guide To Taxes On Retirees Retirement Income Income Tax Tax Free States

Normal Meet Stan Nord Tonight Tonight Stans Nord

Pin By Charlesa Young On Books Worth Reading Glenwood Property Peoria

The Cook County Property Tax System Cook County Assessor S Office

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times

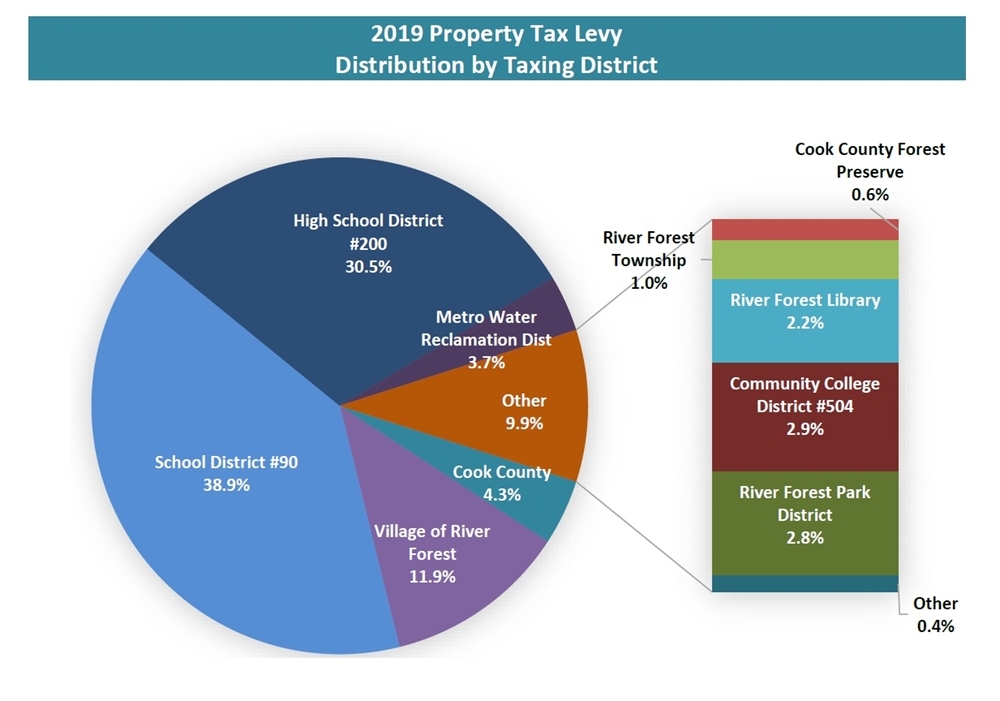

Tax Information Village Of River Forest

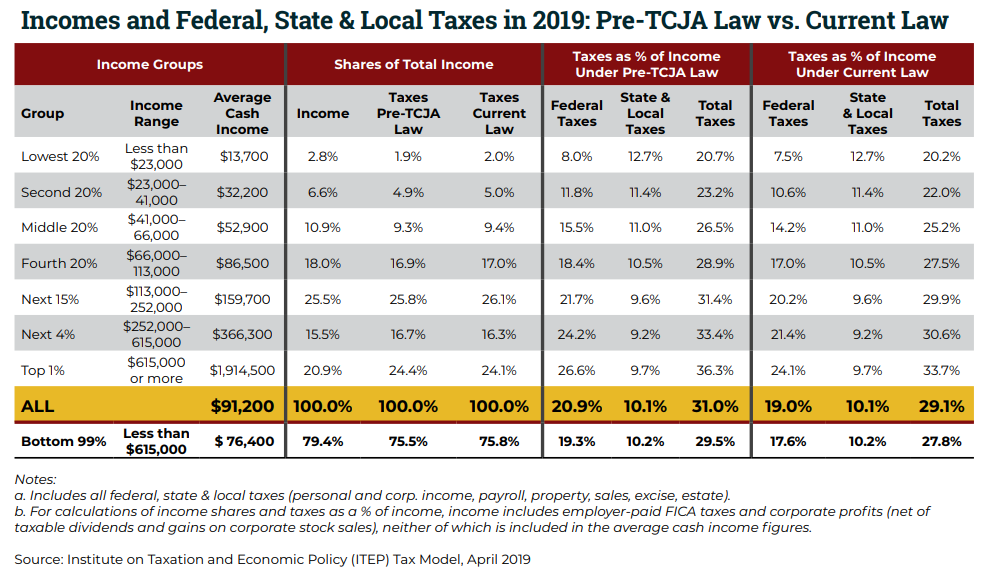

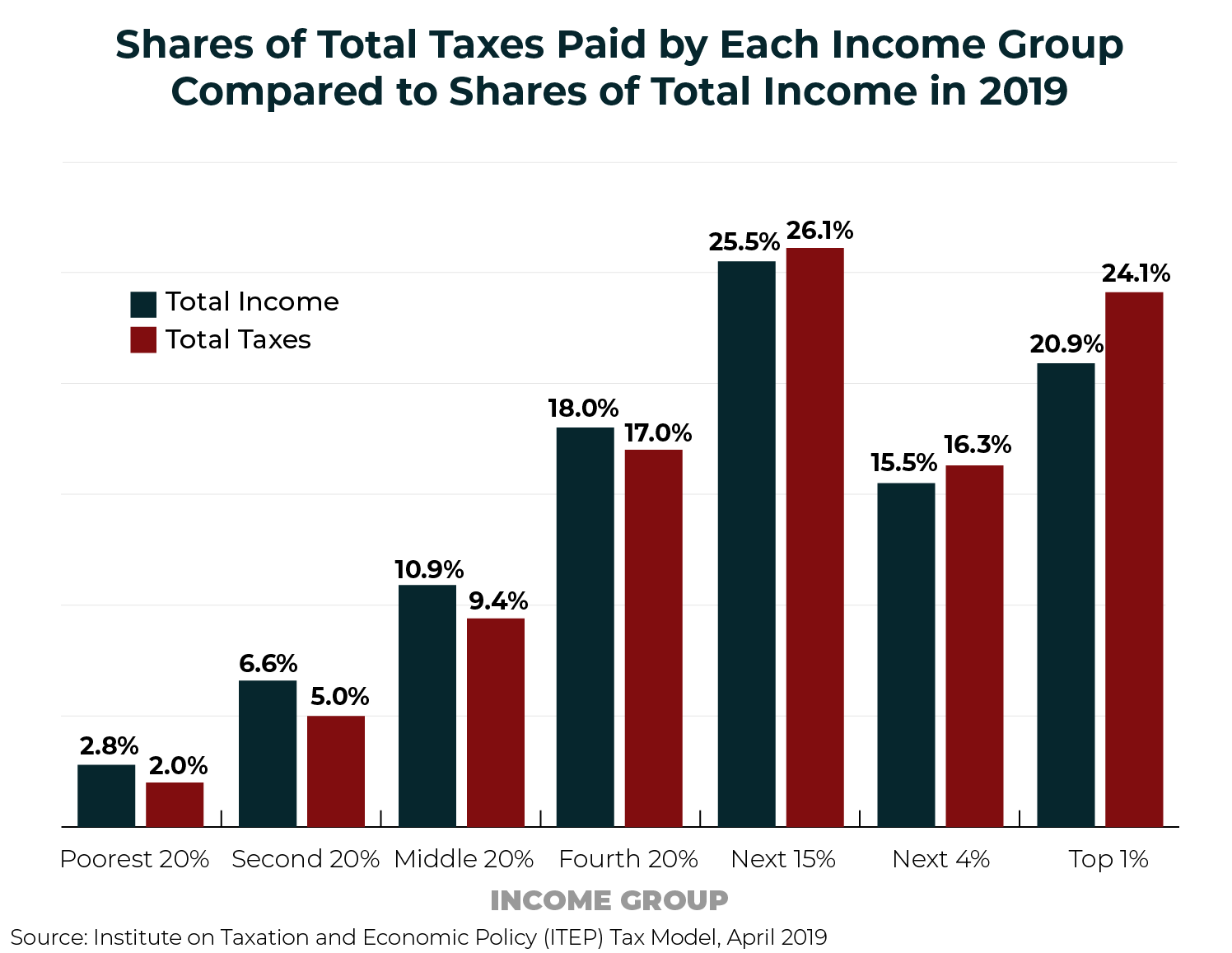

Who Pays Taxes In America In 2019 Itep

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

What S Being Done To Reduce High Property Taxes In Illinois Property Tax Estate Tax Illinois

Who Pays Taxes In America In 2019 Itep

2020 Tax Changes For 1099 Independent Contractors Updated For 2020